| ♥ 0 |

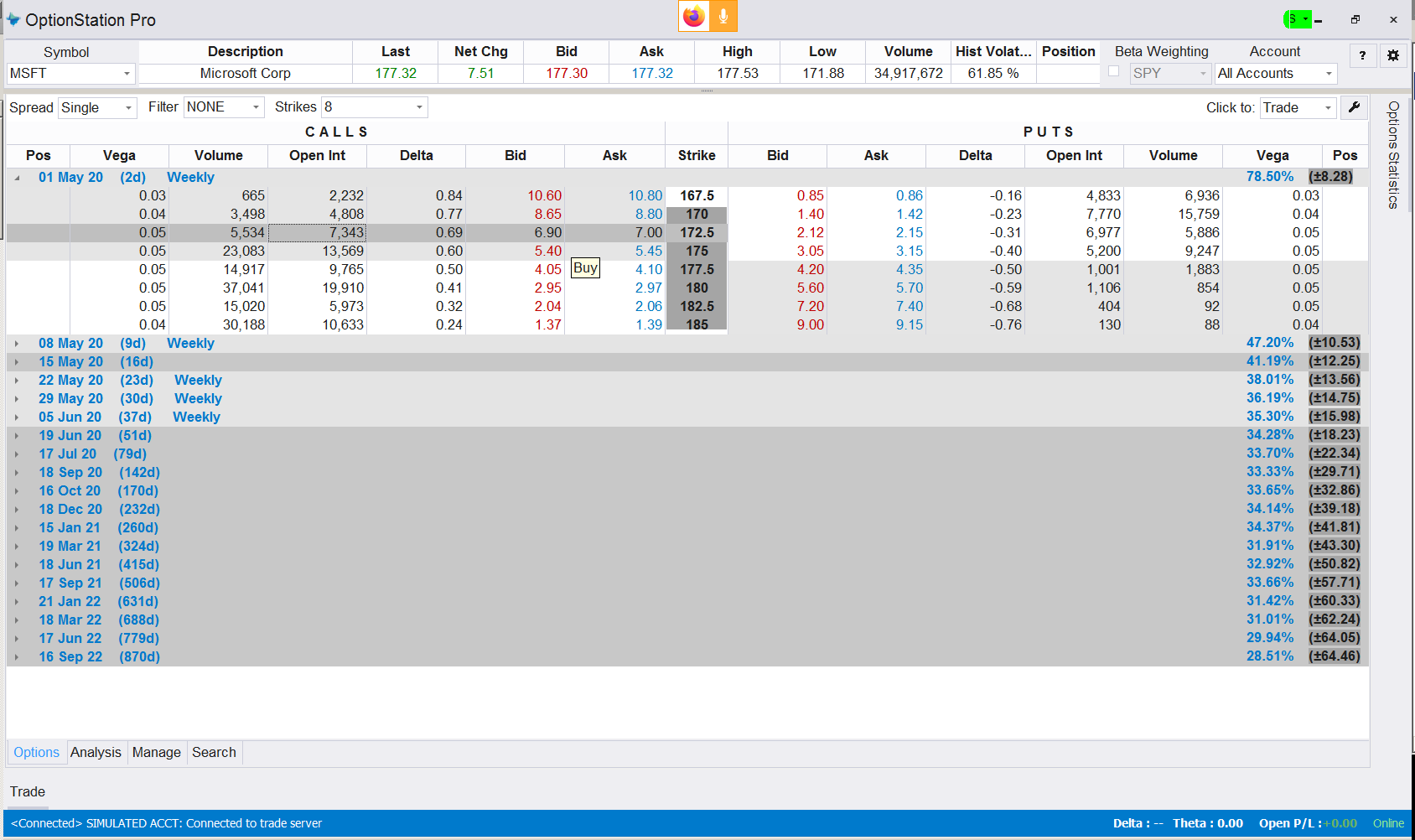

Hello Pete I had a question on easy language in TS. As you see in the attached pic of MSFT the strike price of 172.50 has a bid of 6.90 and a ask for 7.00, so a 10 cents spread How can it be calculated in easy language to check for spread, that if the spread is 5 cents and lower then buy MSFT that strike price otherwise cancel buy. Any thoughts. Thanks.

Marked as spam

|

Please log in to post questions.