| ♥ 0 |

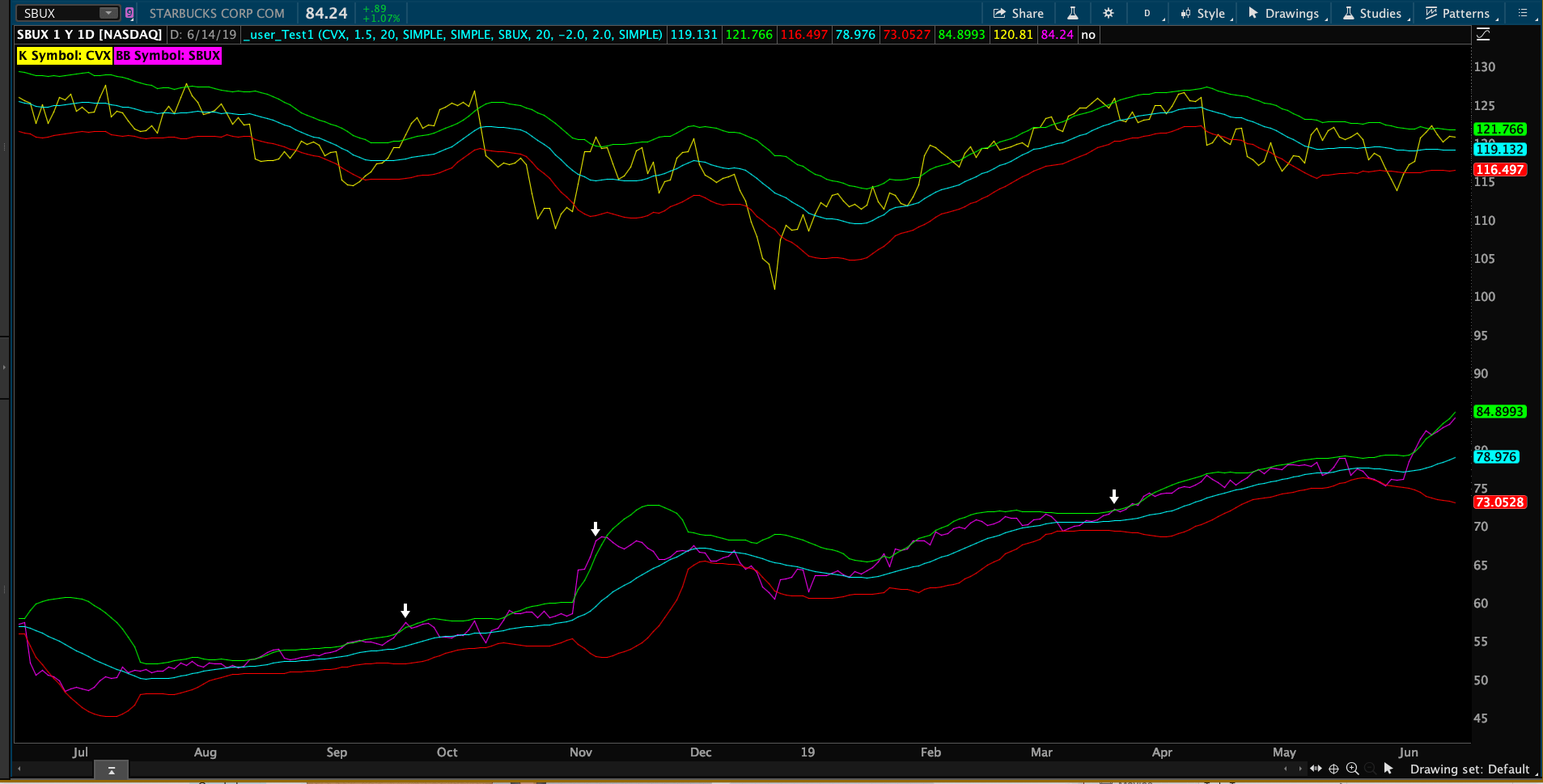

Hi, How would I compose a simple lower study that involves 2 symbols with 2 different studies? For example, I want a plot when current symbol, Symbol A, close is higher than 1.5 of its KeltnerChannels and another symbol’s, Symbol B, close is higher than its upper BollingerBands. I figured out I can use close(“GOOG”) to get price. How do I perform a similar task if want GOOG’s BollingerBand .

Marked as spam

|

Please log in to post questions.

You question is about a chart study. So I have moved this out of the "Frequently Asked Questions" topic and into the "Chart Studies" topic.

I have changed the title of the question to better reflect the context of your question. This makes it easier for other viewers who are seeking a similar solution to search for and find this post.

Your original question title was "Referencing Other Data in TOS". The new question title is "Combine Keltner and Bollinger using different symbols for each"

Now on to your question. I need you to clarify this statement:

"Symbol A, close is higher than 1.5 of its KeltnerChannels"

It would seem that you are actually referring to the close of the bar being higher than the upper band of the Keltner Channel multiplied by 1.5. There are three plots in the Keltner channel study. Please be specific in your request.