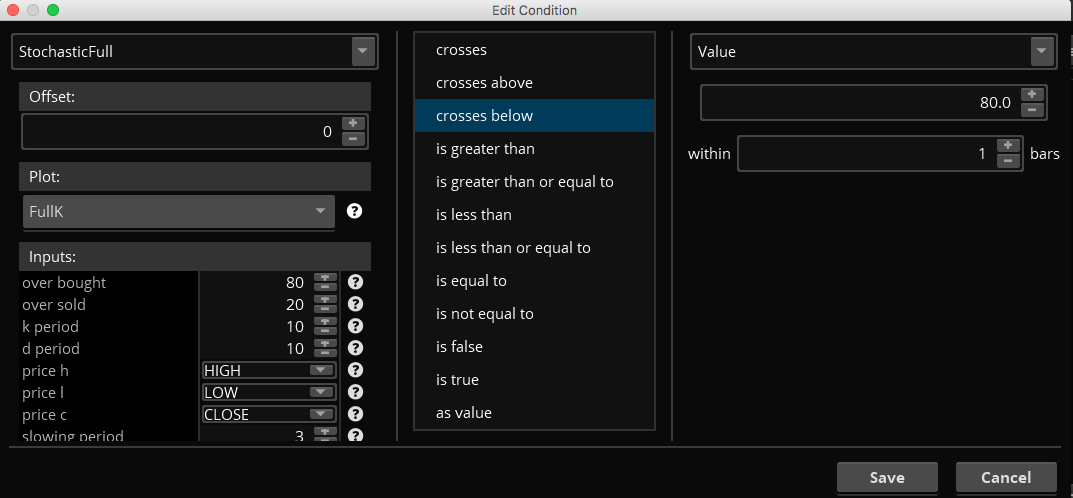

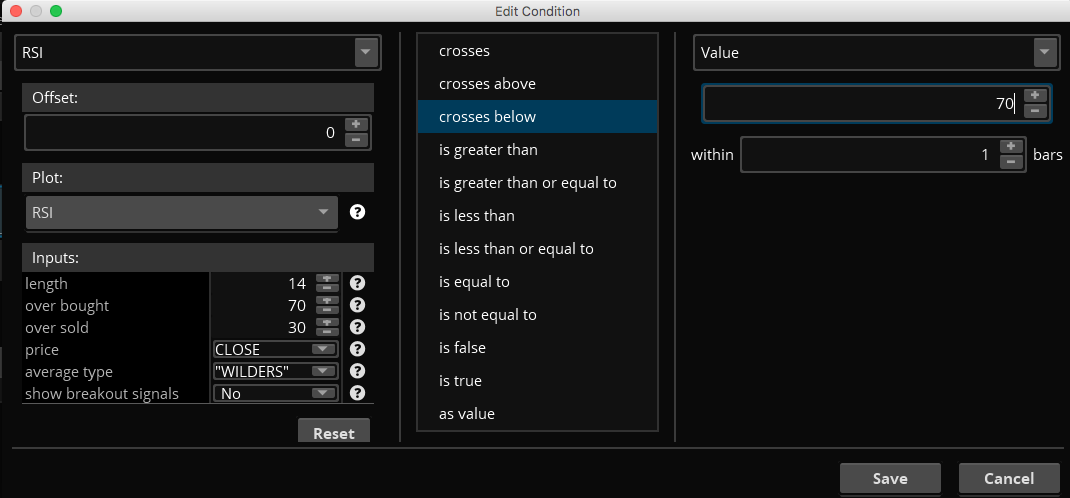

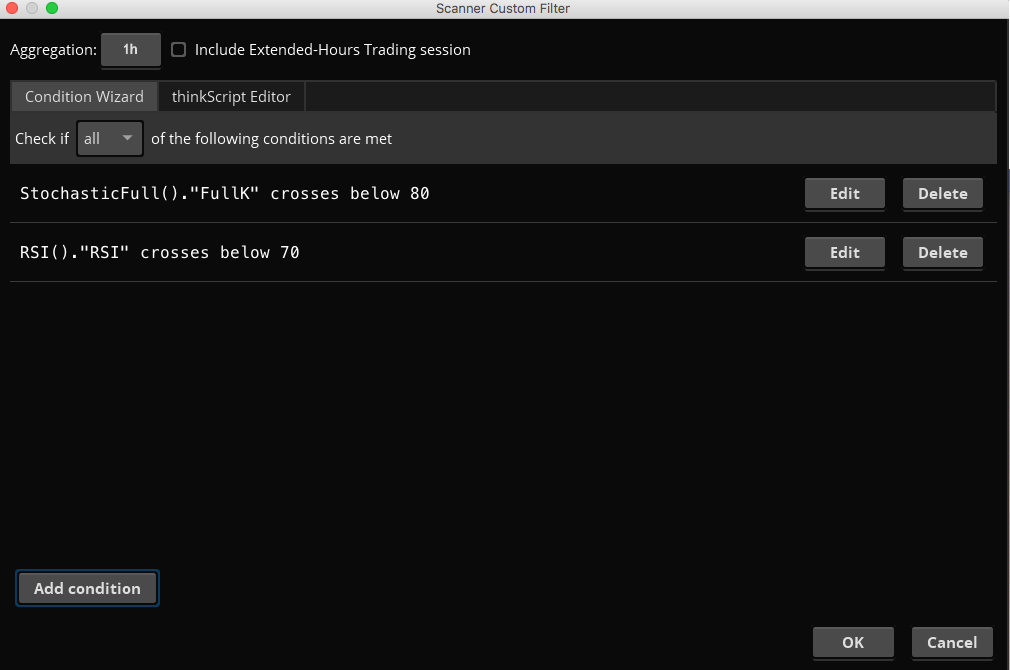

I could probably point to a half dozen different posts on this site the describes either the RSI or the Stochastic portion of this request. Combining them may seem a daunting task. However the solution is so simple that you don’t have to write any code at all. This is accomplished very simply using the Condition Wizard. You create one condition that checks for Stochastic FullK crossing below 80, the create the second condition to check for RSI crossing below 70. These crossing must occur at exactly the same bar if you assemble it in the way pictured in the screenshots below.

Given the rarity of such a pattern I suspect you have left out some key points in your specification.