| ♥ 0 |

Some place I saw a free thinkscript for an offset Probability Of Expiring Cone indicator, but for the life of me, I cannot find it again to get it. Therefore, I was wondering if you could help with this. Below is the thinkscript that I have been trying but it does not work. Basically what I want to be able to do is to have the cone displaced back in time by a variable but set number of days. Thus, what did this cone look like 10 days ago for example. I greatly appreciate your help in this matter! declare real_size; input period = 30; input displace = 0; plot UpProbExp = Double.NaN -displace;

Marked as spam

|

Please log in to post questions.

responding in the comments section of your last answer….

Thanks for explaining things in detail. In no way were my statements meant to indicate there was no value in applying historical ProbExp levels to current price action. You have confirmed this indicator does not, which is the point I was wanting to emphasize. So we are in full agreement.

The source code for this indicator is not available because Thinkorswim has hidden it. Very likely the code for this uses some language elements not available to the general public (it’s not a licensed study yet the source code is hidden). I cannot imagine how one could build an indicator you describe using publicly available language elements in the Thinkscript library.

In fact, I could not even get the built in study to plot using OnDemand looking back 10 days. So the data to compute historical ProbExp levels may not even exist in Thinkorswim.

Regarding: How to create an offset Probability Of Expiring Cone

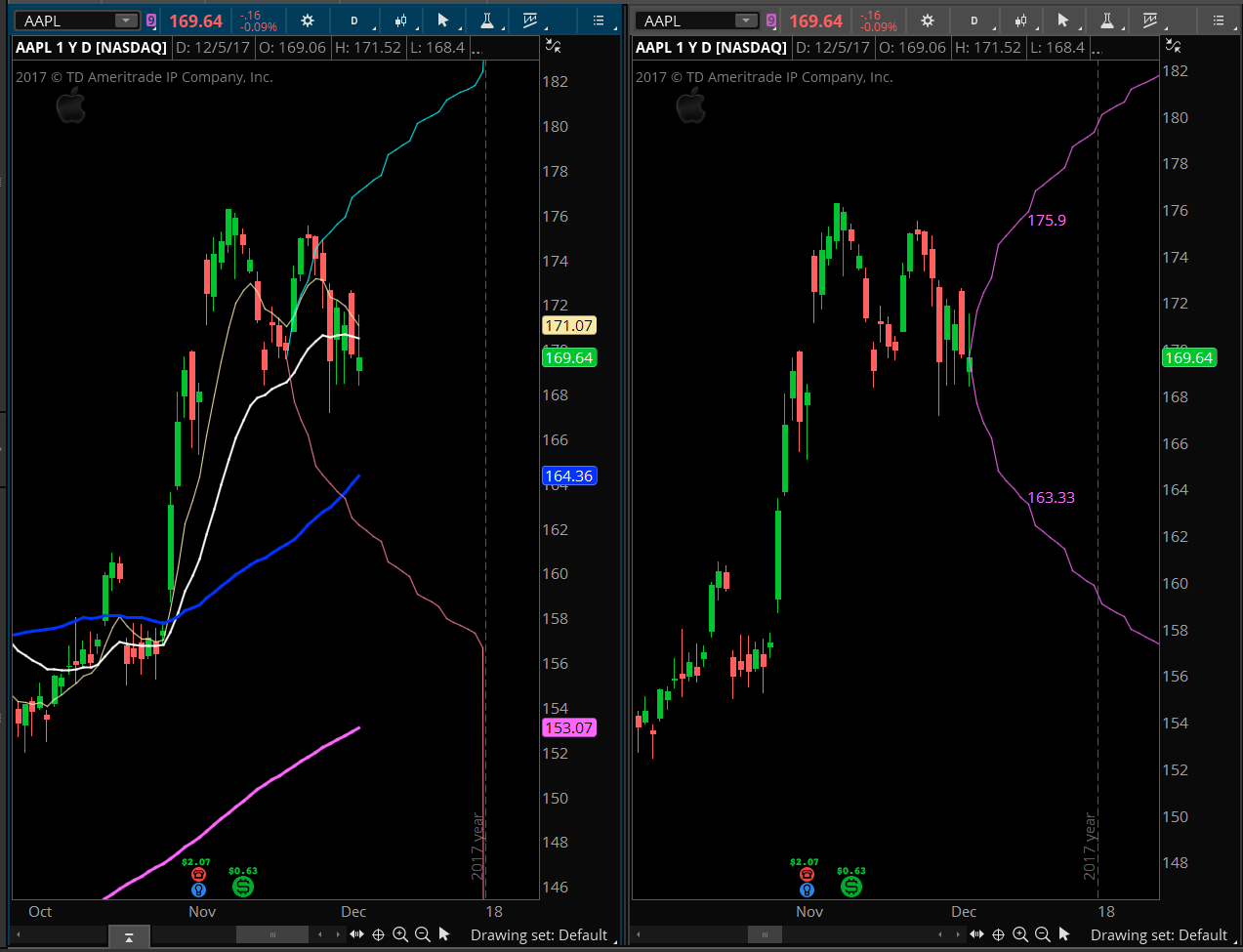

I actually see this as a valuable tool if it can be created. The input should ask for a date to relocate the cone back in time. The cone should then be recalculated up to that date. So, it would not be the current date cone simply relocated.

Here’s why this is important:

The new cone tool would enable the user to visually back-test select option trades, For example, lets say I want to sell a 115 PUT (15 delta) in STMP on 1/30/18 with 45 days until 16MAR18 expiration. While you can find this data in Thinkorswim thinkback, it takes a lot of time to check for the 15 delta strike and then check to see if price touched that level, in the case 115, over the next 45 days.

A new cone tool would save a lot of back-testing time by allowing the cone to be dragged around on the chart and recalculating the cone on the selected historical date.

Thanks for your consideration.

John

Thanks for the input John. I agree. However it’s impossible to program given available tools in Thinkorswim. So your only recourse is to submit a request to TD Ameritrade to have their programers build this into the platform.