| ♥ 0 |

I am now here and kind of new to the TOS platform. Actually it has always intimidated me so I steered clear of it. But I now am trying to embrace and learn. Thank you for this wonderful platform to do so. My question is there are many services that charge to alert us of unusual option activity giving us a clue as to price projections or good/bad news coming or a potential larger than normal move. Is there a way to scan for this?

Marked as spam

|

|

Private answer

Hi Pete / Ryan; I came across this code that I use in my watch-list & when I scan for options, hope it helps. The column turns RED & reads “volume vs OI” when Vol is greater that OI. Thanks Pete for all you do.

def alert = volume > open_interest;

Marked as spam

|

|||||||||

|

Private answer

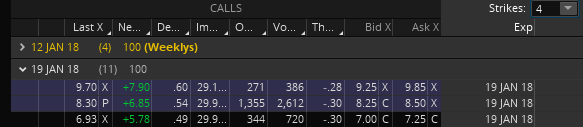

What about a scan that shows a stock option with volume greater than open interest. Be able to search based on a call or put and then for open interest value = XX (be able to input your range of values) and volume is % or a certain amount like 100+, 500+, 1000+, etc. higher than the OI. Look at TSLA (attached) The call side volume is higher than OI. Can a scan be created to show this if the parameters you set before hand match? Marked as spam

|

|||||||||

|

Private answer

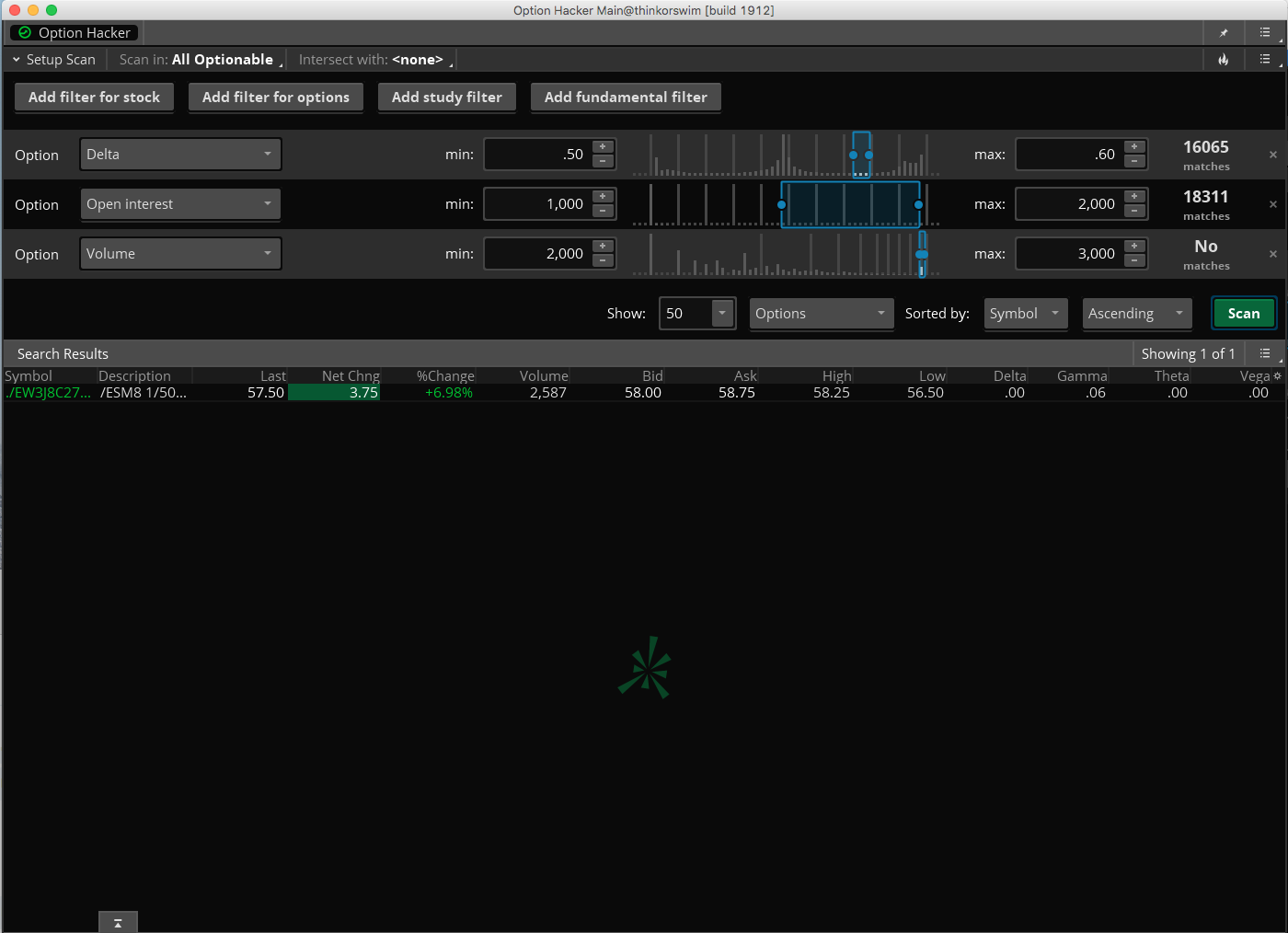

In response to a suggestion offered by Ryan on 1/8/18. Stock Hacker is made to scan for stocks, not options. So any scan you run will only return a list of stocks, not options. The only tool we can use for your suggestion is called Options Hacker. Attached screenshot shows one method that may work. But you have to accept there is some amount of overlap in the comparison between volume and open interest. What I mean is that here I have set open interest to a range of 1,000 to 2,000 while volume is set to a range of 2,000 to 3,000. You will pick up options where the volume is twice the open interest: (OI = 1000 & Vol = 2000). But you will also pick up options where they are equal: (OI = 2000 & Vol = 2000) Notice we can add Study Filters to the Option Hacker scanner. You can use the condition wizard to build a filter like this:

And by logical extension you would think you could just multiple OI by 2 to reach your goal:

However I have run some test scans using only this filter. It doesn’t work. It doesn’t work when you use Greater Than and it doesn’t work when you use Less Than. (and I tried it without adding the * 2 to open interest) This tells me it simply does not work. Period. Marked as spam

|

Please log in to post questions.

This question has been asked in various forms. The straight is no. I have not found a way to create any scans that detect unusual volume for options. That doesn’t mean it can’t be done. Only that at this time I have not discovered whether it is possible.