| ♥ 0 |

Hello. I am trying to scan for options based off the following criteria

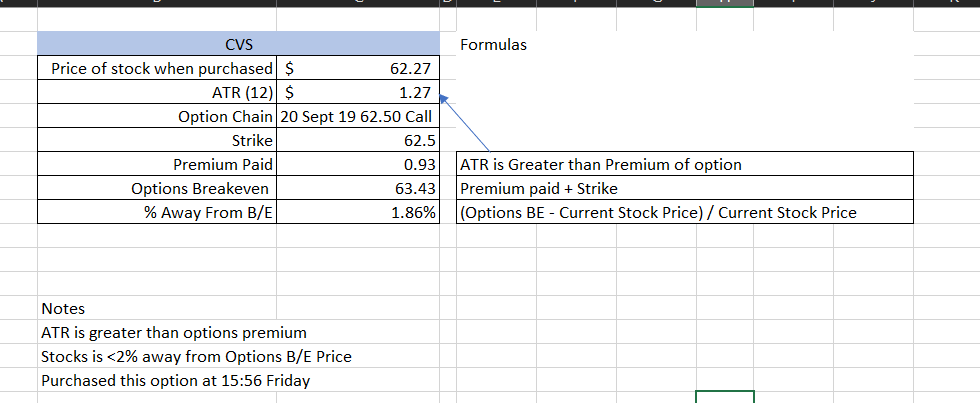

The end results would be for the scan to show options strikes and expiration’s that fit the criteria above. I have included a screenshot of a Options position in CVS I entered Friday that fit the criteria of -ATR is greater than premium of option – Stock is <2% away from the break-even price

Marked as spam

|

|

Private answer

I don't think we can build a scan for this in Thinkorswim. Here is the first set of metrics we need to compare: ATR of the underlying stock and the theoretical (or last) price of the option Using the study filter, we can very simply compute the ATR for the underlying stock. However in order to compute the theoretical price of the options requires that we use a function called "OptionPrice". Details here: https://toslc.thinkorswim.com/center/reference/thinkScript/Functions/Option-Related/OptionPrice.html As user defined inputs we need to supply the following: strike: getStrike() You can see that in order to compute the theoretical options price we have a very narrow scope. You must know before hand, which strike price and days to expiration you want to target with your scan. Something I'm sure you were hoping the scan would accomplish for you. Despite having the reputation for being one of the foremost platforms for trading options, the language for Thinkorswim is severely lacking in tools needed to accomplish very basic tasks related to options strategies. Marked as spam

|

Please log in to post questions.