Hi Pete, could you please try adding the previous day’s HLC to the code below with the same formatting? Thank you

***************************************************

declare hide_on_daily;

input PlotOverNightExtremes = yes;

input DisplayPriceBubbleOnHiLowBar = yes;

input DisplayPriceBubbleOnRightEdge = yes;

def o = open;

def h = high;

def l = low;

def c = close;

def v = volume;

def bar = BarNumber();

def GDF = GetTime() < RegularTradingStart(GetYYYYMMDD());

def vol = if GDF and !GDF[1]

then v

else if GDF

then vol[1] + v

else Double.NaN;

def GDF_Volume = vol;

def ONhigh = if GDF and !GDF[1]

then h

else if GDF and

h > ONhigh[1]

then h

else ONhigh[1];

def ONhighBar = if GDF and h == ONhigh

then bar

else Double.NaN;

def ONlow = if GDF and !GDF[1]

then l

else if GDF and

l < ONlow[1]

then l

else ONlow[1];

def ONlowBar = if GDF and l == ONlow

then bar

else Double.NaN;

def OverNightHigh = if BarNumber() == HighestAll(ONhighBar)

then ONhigh

else OverNightHigh[1];

def OverNightLow = if BarNumber() == HighestAll(ONlowBar)

then ONlow

else OverNightLow[1];

#

plot ONH = if OverNightHigh > 0

then OverNightHigh

else Double.NaN;

ONH.SetHiding(!PlotOverNightExtremes);

ONH.SetPaintingStrategy(PaintingStrategy.SQUARES);

ONH.SetDefaultColor(Color.BLUE);

ONH.HideBubble();

ONH.HideTitle();

#

plot ONL = if OverNightLow > 0

then OverNightLow

else Double.NaN;

ONL.SetHiding(!PlotOverNightExtremes);

ONL.SetPaintingStrategy(PaintingStrategy.SQUARES);

ONL.SetDefaultColor(Color.LIGHT_GRAY);

ONL.HideBubble();

ONL.HideTitle();

# Bubble code

AddChartBubble(bar == ONhighBar and PlotOverNightExtremes and DisplayPriceBubbleOnHiLowBar, ONH, “ONH: ” + ONH, createColor(204,204,255));

AddChartBubble(bar == ONlowBar and PlotOverNightExtremes and DisplayPriceBubbleOnHiLowBar, ONL, “ONL: ” + ONL, createColor(204,204,255),no); #designated that the bubble be painted below the ONL line. 2018-04-07 JQ

AddChartBubble(barNumber() == highestAll(barnumber()) and PlotOverNightExtremes and DisplayPriceBubbleOnRightEdge, ONH, “ONH: ” + ONH, createColor(204,204,255));

AddChartBubble(barNumber() == highestAll(barnumber()) and PlotOverNightExtremes and DisplayPriceBubbleOnRightEdge, ONL, “ONL: ” + ONL, createColor(204,204,255),no);

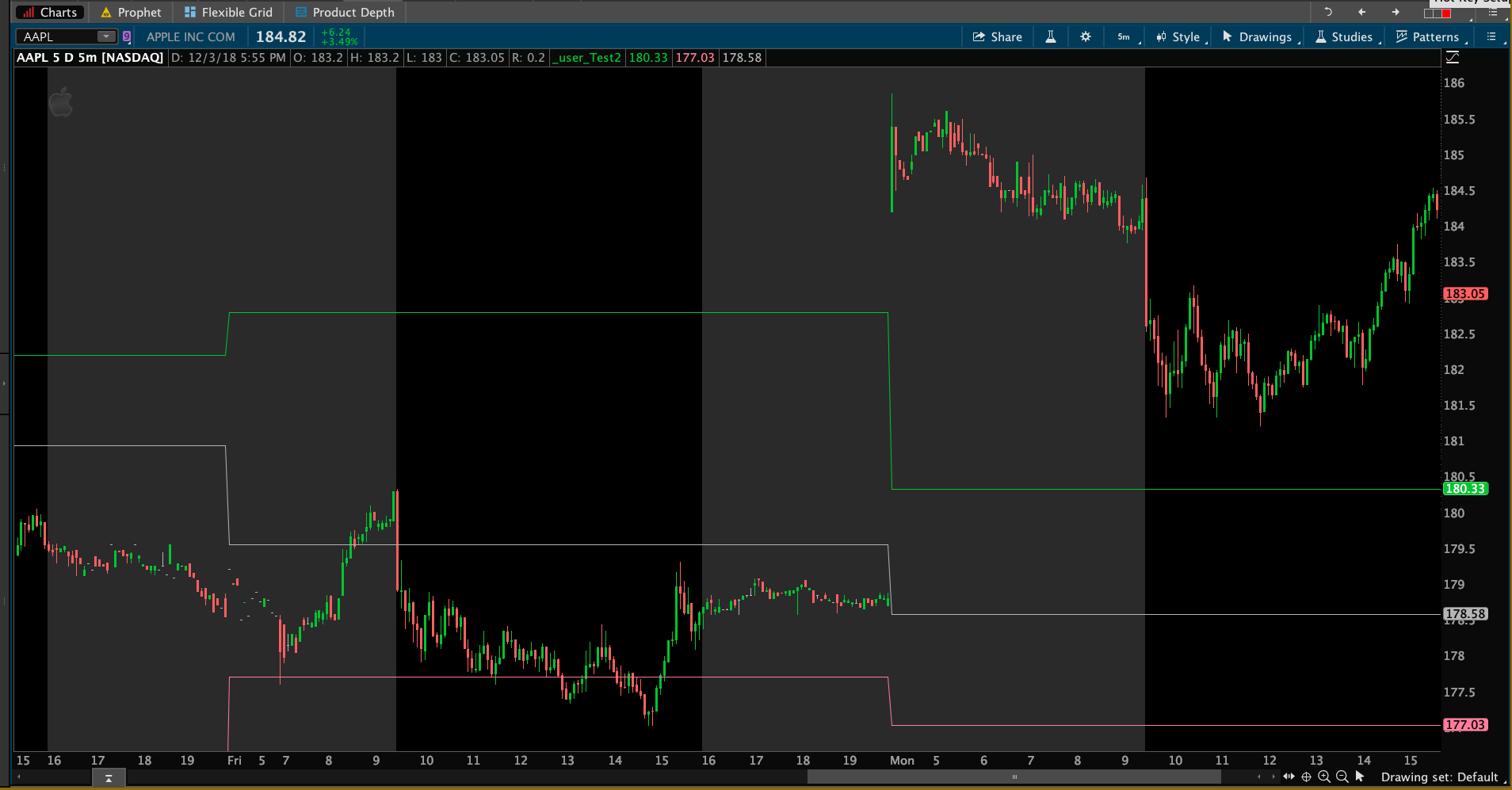

Like this:

Like Loading...

So when you say “HLC” do you mean (high + low + close) / 3?

Does that computation need to include premarket hours trade or only regular session trade?

Thanks for your response, Pete. Sorry for the lack of clarity. I meant the previous day’s High, Low and Close price levels to be plotted separately at the level extremes like the code to pre-market above shows.

Thank you for your help.

Ok, daily high, low and close. Still need to know….”to include premarket hours trade or only regular session trade”

Sorry, with pre-market hours. Much appreciated!