| ♥ 0 |

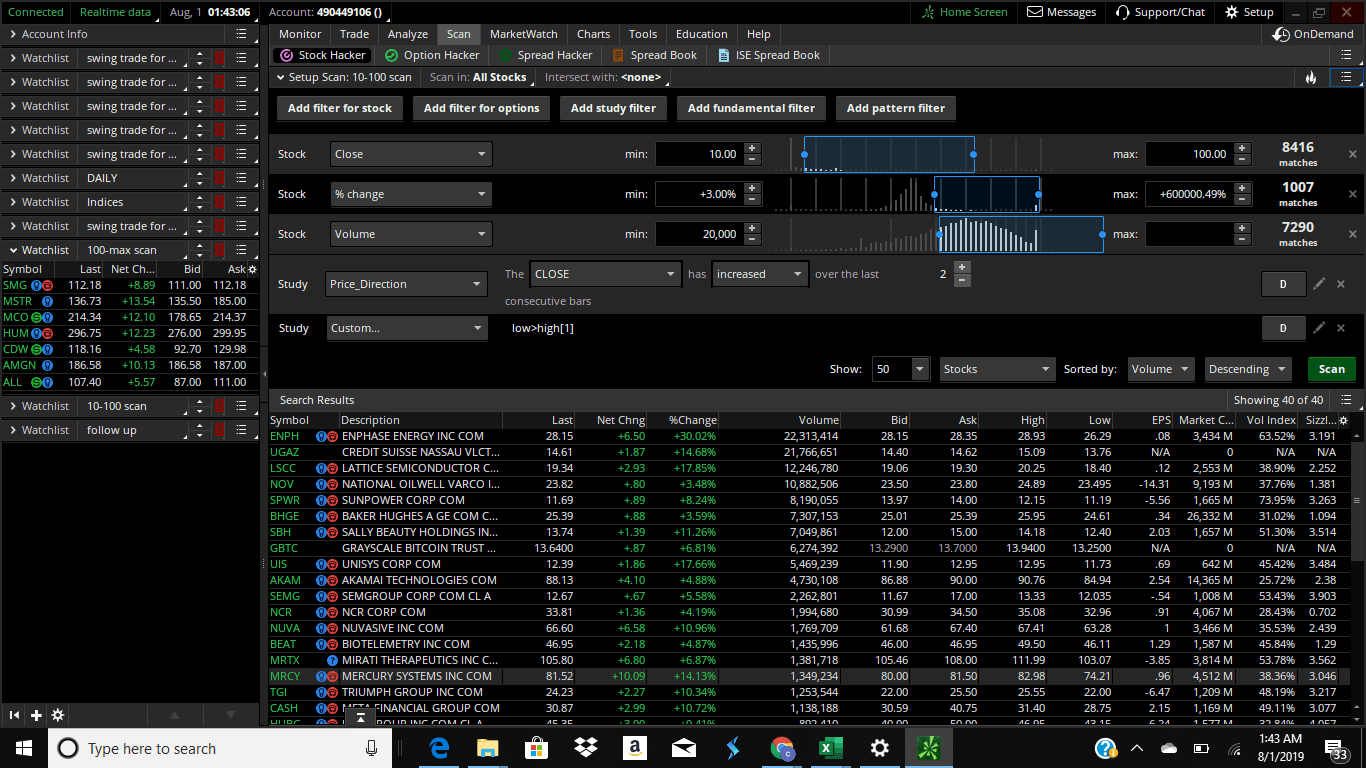

Okay guys so I’m trying to gain the ability to backtest a momentum strategy that I normally use as a scan The criteria for the scan are 1.5 times above average volume, gap up or low>high[1] and a exit signal that either occurs at the end of the week or in the form of a trail stop I’ll post a picture of the scan

Marked as spam

|

|

Private answer

We published an entire video dedicated to this topic: https://www.hahn-tech.com/thinkorswim-scan-to-strategy/ It is expected that the first three filters in your scan are already accounted for before you plot the symbol on the chart for backtesting. You only need to convert the two Study Filters over to the Chart Strategy. The video shows exactly how to do that part. Marked as spam

|

Please log in to post questions.