| ♥ 0 |

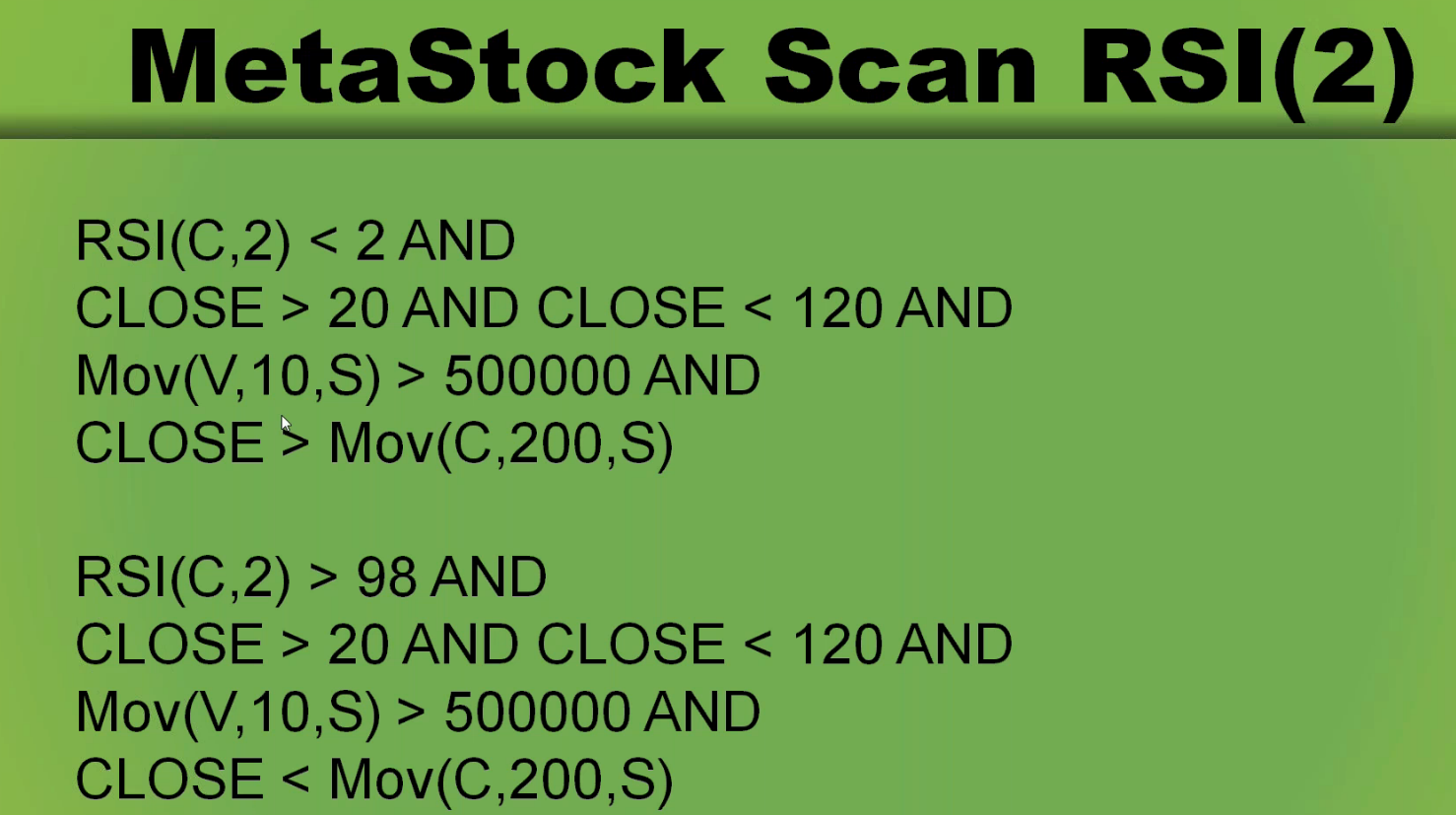

Hi Pete, See attached screen shot. Please show how to convert this MetaStock code to Thinkscript scanner using RSI(2). Thank you.

Marked as spam

|

|

Private answer

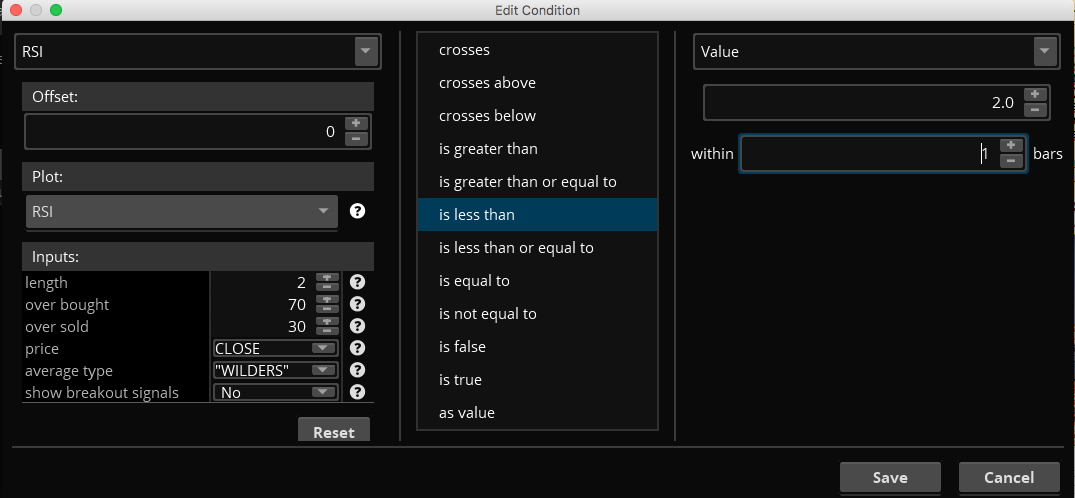

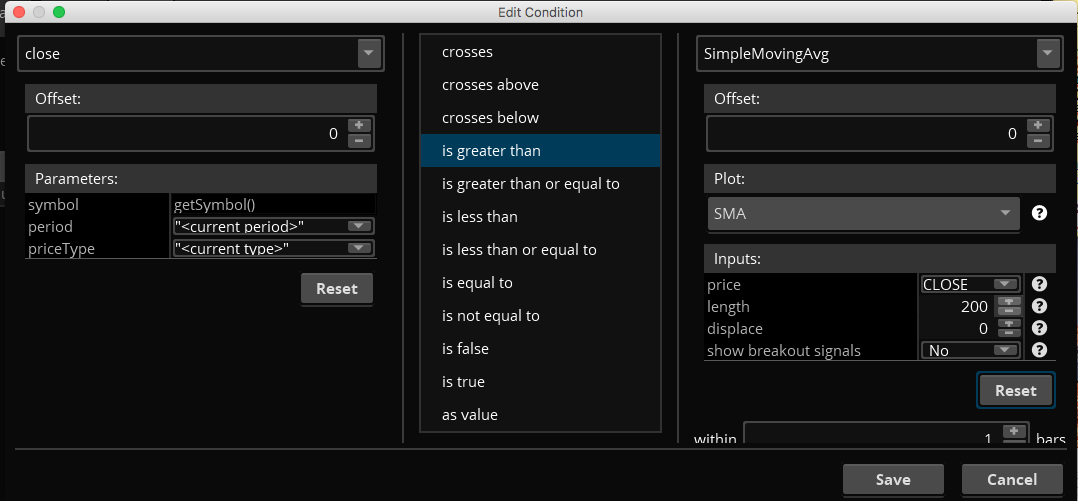

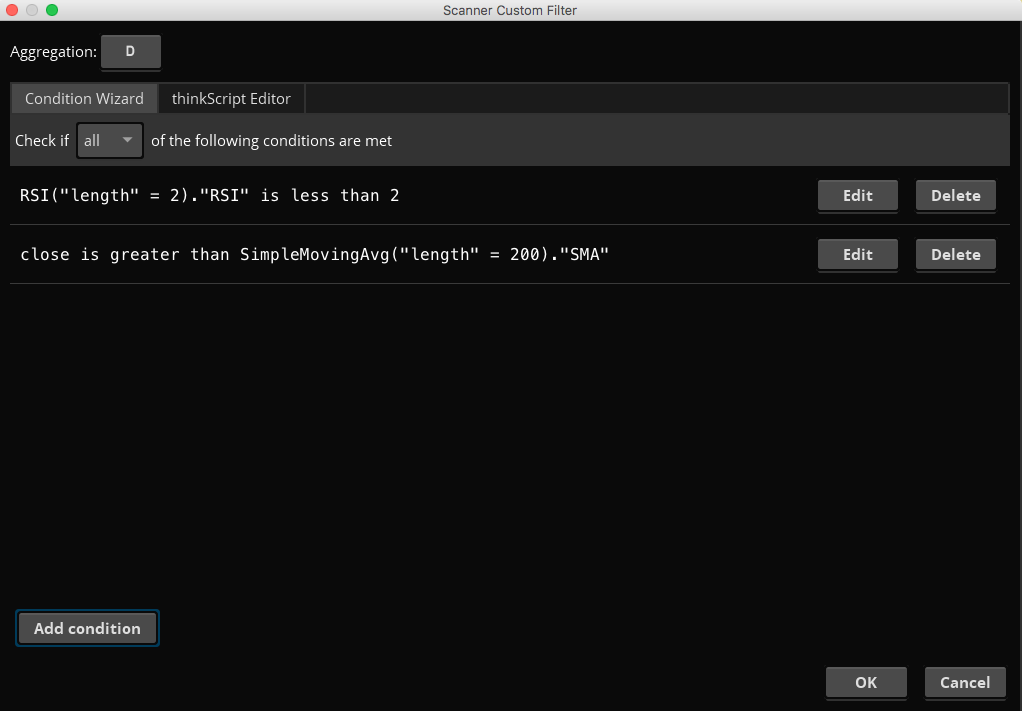

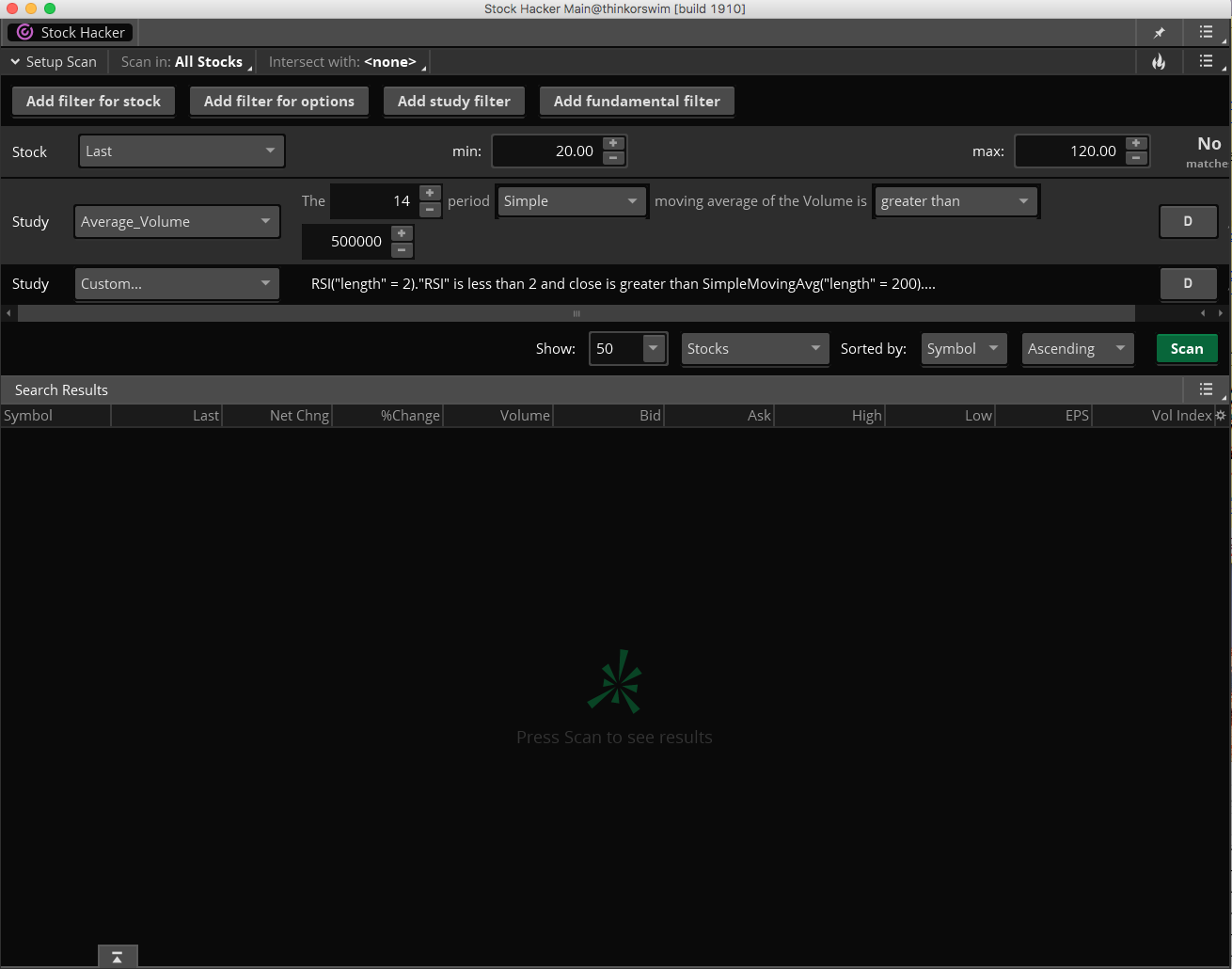

Ok, this is a very basic scan based on a standard RSI using a period length of 2. The rest of the filter is just checking share price, average volume and position of price relative to a 200 moving average. Not sure why they presented this as a formula, as it would have been so much easier to write this out in plain english. As I just did. I preset a series of screenshots showing how to use the condition wizard to build the RSI and the moving average filter. These are combined together into a signal study filter. The last screenshot shows the entire scan, which is where you see the standard filters for Last price between 20 and 120 and average volume greater than 500,000. Marked as spam

|

|||||||||||

|

Private answer

I noticed something on the average volume. It should be greater than 500,000. Why did it select those stocks that have less than 500,000 (see screen shot)? Marked as spam

|

|||||||||||

|

Private answer

Sorry that you have become disoriented. The screenshot below, of this very post, should help clear things up. Marked as spam

|

|||||||||||

|

Private answer

Kim, I am always looking for mind like investors, from your line of requests, we seem to be looking for similar strategies. would mind if we connect via email ? Marked as spam

|

|||||||||||

|

Private answer

ok good, lets connect darwishes at yahoo dot com Marked as spam

|

Please log in to post questions.

We need to avoid duplicate title names. Let’s not title all of these “Translate from metastock….”. Nobody will ever be able to search for a find a solution. What is this scan called? It cannot be called RSI(2). Because that is nothing more than saying scan for a two period RSI reaching over bought or oversold. That is all you have there.

And you have the close between 20 and 120 per share. Then the average volume has to be greater than 500,000 and the close has to be above the 200 simple moving average. There is nothing here that needs any code. It can be built very simply from the standard filters included in the Thinkorswim platform. Where are you getting this stuff? And don’t they bother to explain what these are?

From a webinar. No, they didn’t tell me. I’ll try to build it from the standard filters and see how it turns out. Thanks!

Ok, well check the terms and conditions. We are not here to reverse engineer someone else’s work. If you see something on a webinar and you feel it can make you money, than pay them for their work. I only expect the same when folks are viewing my own premium indicators.

They were given it out for free (in fact, they encouraged to convert it to our own trading platform). It was just a study and no guarantee to make money.

Oh, ok. That is good to know then. Sorry but have a hair-trigger when it comes to folks trying to get me to reverse engineer other developers work. I’ll go ahead and post a screenshot later, showing how this one is built using standard items included in Thinkorswim scan engine.