How to Use and Customize Watchlists on Thinkorswim Mobile App

Thinkorswim Mobile Watch List

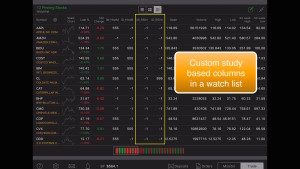

Customized watch lists on the mobile version of Thinkorswim? Yep, we got that. Have a favorite scan you would like to display in a custom column of a watch list? Yep, we can do that. Multiple time frames? Yep, we got that too. This video demonstrates all the features of the watch list in the Thinkorswim Mobile app. We show you how to build your custom columns in the desktop version, which are immediately available in the mobile app. How? The data is automatically stored on TD Ameritrade’s servers. Making the custom columns available almost anywhere you can log in to your Thinkorswim account.

The video is linked below. But after viewing, be sure to scroll to the bottom of this post to access embedded custom code you can copy and paste right into your own custom columns on the desktop version of Thinkorswim. As soon as you do that, they are immediately available on the Thinkorswim mobile app.

DISCLAIMER: I AM NOT A CERTIFIED FINANCIAL ADVISOR AND NOTHING IN THIS VIDEO OR TEXT IS AN ADVERTISEMENT OR RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT. NOR IS THIS VIDEO OR TEXT INTENDED TO INSTRUCT YOU ON HOW TO MAKE BUY OR SELL DECISIONS USING ANY OF THESE INDICATORS.

*Thinkorswim is a chart analysis platform offered by TD Ameritrade: www.tdameritrade.com

TD Ameritrade provides financial services including the trading of Stocks, Futures, Options and Forex.

Please be sure to share this page with your friends and colleagues. Leaving comments below is the best way to help make the content of this site even better.

Watch the video, Thinkorswim Mobile Watch List below:

This is the code for the custom column that shows when the MACD histogram is trending upward.

def Hist = MACDHistogram();

def signal = Round(Hist - Hist[1], 2) > 0;

plot Dir = if signal then 555 else -1;This is the code for the custom column that shows when the RSI has hit the oversold range and the MACD histogram has started trending upward.

input fastLength = 12;

input slowLength = 26;

input MACDLength = 9;

input averageTypeMACD = AverageType.EXPONENTIAL;

def Diff = MACD(fastLength, slowLength, MACDLength, averageTypeMACD).Diff;

input length = 14;

input price = close;

input averageType = AverageType.WILDERS;

def NetChgAvg = MovingAverage(averageType, price - price[1], length);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def pivotLowMACD = Diff > Diff[1] and Diff[1] > Diff[2] and Diff[2] < Diff[3] and Diff[3] < Diff [4];

def pivotHighMACD = Diff < Diff[1] and Diff[1] < Diff[2] and Diff[2] > Diff[3] and Diff[3] > Diff[4];

def oversoldRSI = RSI <= 30; def overboughtRSI = RSI >= 70;

# only plot one of these two.

# uncomment the one you want to scan. Leave the other commented out

def signal = pivotLowMACD and highest(oversoldRSI[1], 4) > 0;

#def signal = pivotHighMACD and highest(overboughtRSI[1], 4) > 0;

plot scan = if signal then 999 else -1;